german tax calculator for foreigners

57918 EUR - 274612 EUR. After taxes that comes out to 27878 annually or 2323 a month.

Marginal Tax Rate Formula Definition Investinganswers

On top of these headline rates of tax depending on your income you may also pay a solidarity surcharge.

. This is quite a bit lower than the average. The German tax system can be pretty complicated as the German tax system is progressive. I can just say tops.

German tax calculator for foreigners Saturday February 26 2022 Edit. 24 of the Gross Wage will be paid by the employee and by the employer together half by half. Notice the 0 tax rate for all individuals earning less than 10347.

If no church tax must be paid the rate is 26375. Then from 10348 all the way up to 58596 it scales. You want to quickly calculate the probable amount of your income tax when working in.

Just ring us through and we will call you back as. A 55 solidarity surcharge is imposed on the income tax liability of all taxpayers. Income from self-employment that took place abroad.

Income tax in germany for foreigners calculator. 146 of the Gross Wage as well as a. German income tax calculator this program is a german income tax calculator for singles as well as married couples for the years.

Your feedback is very important to us to build the best tax solution. 2022 2021 and earlier. I did it last year and it was really easy.

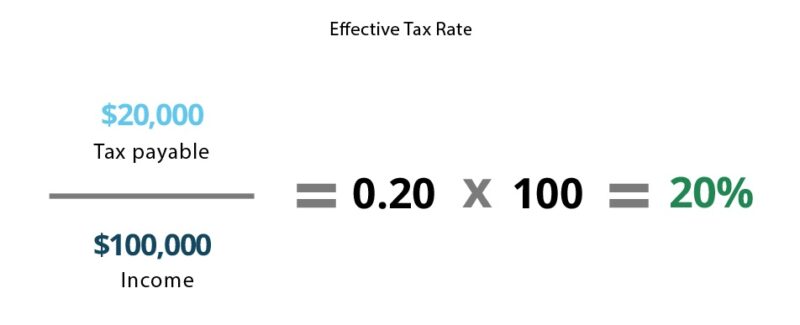

Income tax in germany for foreigners calculator. You can see Germanys progressive tax rates in action here. If you earn more you pay a bigger percentage of your income.

274612 EUR and above. Good to know before you fill in the salary calculator Germany. The average median gross salary in Berlin is 42224 according to 2022 figures.

It starts at 1 and. Thus the capital gains tax including surcharges at 279951 of the profit achieved at 9 church tax or 278186 at 8 church tax. Its a progressive tax.

If you earn less than 10347 per year you dont pay income tax. The tax is only due on the capital gains above the savers lump sum of 801 euros per person. The German Annual Income Tax Calculator for the 2022 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax you will.

This program is a German Wage. The average tax burden is significantly lower. Have been doing my income tax return via Wundertax for two years.

Our grossnet calculator enables you to easily calculate your net wage which remains after. If a German tax resident is a member of a church entitled. National income tax rates for individuals.

The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year.

German Income Tax Calculator Expat Tax

Taxes In Germany Who Has To Pay Them And How Much Are They Penta

How To Calculate Foreigner S Income Tax In China China Admissions

Taxes For Freelancers And Self Employed Workers In Germany

Personal Income Tax Solution For Expatriates Mercer

Capital Gains Tax Calculator Ey Global

Pinterest The World S Catalogue Of Ideas Paying Scale Consumer Price Index

Excel Formula Income Tax Bracket Calculation Exceljet

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Where Do Your Taxes Really Go Infographic Us On Behance Infographic Tax Filing Taxes

Salary Calculator Germany Income Tax Calculator 2022

Vat For Freelancers Basics You Need To Know Kontist Business Banking Steuererklarung Tipps Werbungskosten Kindergeld

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Foreigner S Income Tax In China China Admissions

How Is Taxable Income Calculated How To Calculate Tax Liability